“Restructuring isn’t just about survival, it’s about rebuilding trust with creditors, clients, and staff while creating a sustainable future.” – John Morgan, Director.

Why Construction Debt Restructuring Matters

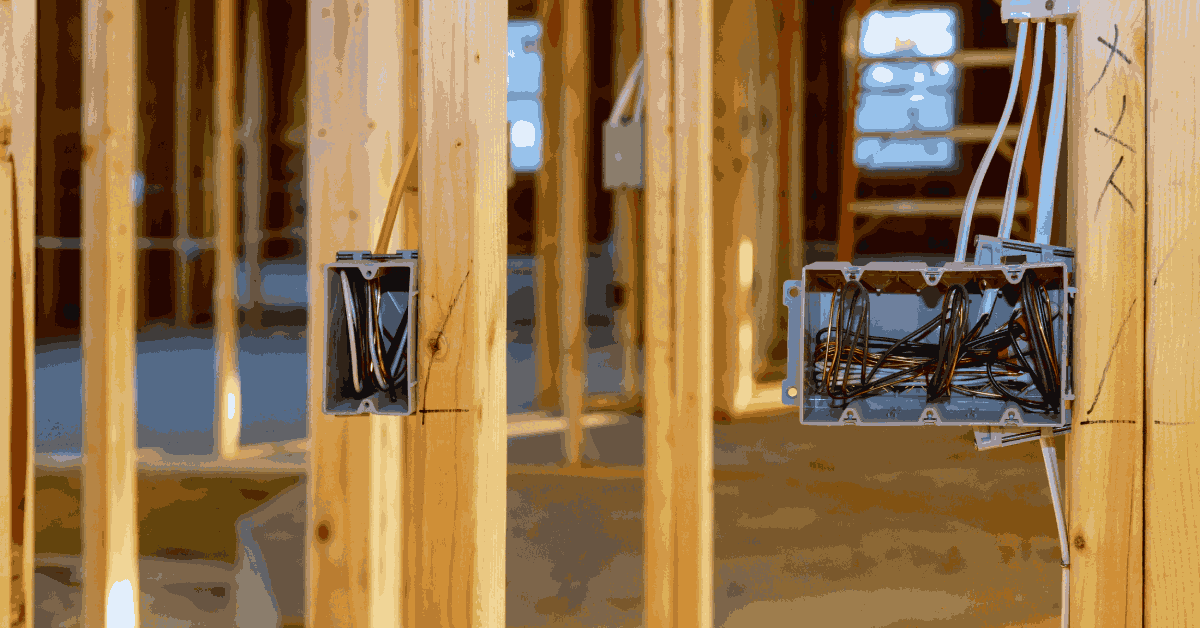

The construction and electrical services industry has faced mounting challenges in recent years, from cost escalations and project delays to rising tax debt pressures. For many operators, Construction Debt Restructuring has become a critical tool to navigate financial stress without closing their doors.

The experience of this company, a construction and electrical services company, highlights both the opportunities and hidden risks that come with restructuring. By looking closely at this case, business owners can better prepare for what lies ahead.

Ignoring the Early Warning Signs

One of the most common mistakes construction firms make is waiting too long to act. Businesses often juggle supplier debts, unpaid tax obligations, and cashflow challenges, hoping the next project will solve everything.

But in reality, delays only shrink your options. Construction Debt Restructuring works best when directors act early, before creditors lose patience and before insolvency laws leave no choice but liquidation.

Choosing the Wrong Advice

Not all advisers are created equal. Directors who seek informal or unqualified advice may find themselves in deeper trouble, with poorly drafted restructuring plans that creditors reject outright.

The company case shows the difference a skilled Restructuring Practitioner can make. With professional oversight, the company created a plan that reassured creditors, balanced tax debts with supplier payments, and offered a realistic path forward.

Without the right advice, even the best intentions can lead to failure.

Overestimating Revenue Recovery

A major pitfall in Construction Debt Restructuring is building a plan on overly optimistic forecasts. Construction and electrical service businesses face unpredictable conditions: weather delays, labour shortages, and project cancellations.

If revenue assumptions are inflated, creditors may approve a plan that quickly collapses, leaving the business worse off. Successful restructurings, like this company, are grounded in conservative estimates, ensuring commitments remain achievable.

Failing to Maintain Creditor Trust

Trust is everything in restructuring. Creditors, especially the ATO, suppliers, and subcontractors must believe the business is acting in good faith. Hidden liabilities, poor communication, or inconsistent updates can damage that trust.

In the company case, open dialogue with creditors was central to gaining support. Detailed financial disclosures and clear repayment terms gave creditors confidence that restructuring offered the best return compared to liquidation.

Failing to build and maintain that trust is one of the most dangerous risks in any restructuring process.

Losing Focus After Approval

Perhaps the biggest hidden risk is complacency. Many directors breathe a sigh of relief once creditors approve the restructuring plan, but that is when the real discipline is needed.

Restaurants, retailers, and construction firms alike have seen restructures fail because directors slipped back into old habits, overtrading, underreporting, or neglecting compliance.

This company avoided this pitfall by implementing stronger internal controls, monitoring cashflow closely, and ensuring directors remained accountable to the plan. Construction Debt Restructuring only works when businesses stay focused long after approval.

Lessons from This Company Experience

This case shows that while Construction Debt Restructuring can provide a lifeline, it is not without challenges. Success depends on:

- Acting early when financial stress becomes visible.

- Seeking guidance from a qualified Restructuring Practitioner.

- Building conservative, realistic repayment plans.

- Communicating transparently with all creditors.

- Maintaining discipline and accountability after approval.

Final Thoughts

The construction sector in Australia is no stranger to financial pressure, with rising input costs and labour constraints continuing to strain margins. Yet, as the company case illustrates, Construction Debt Restructuring can transform financial stress into long-term stability, if the risks are properly managed.

Business owners must understand that restructuring is not just a legal process, it’s a leadership test. By taking decisive action, engaging the right expertise, and committing to transparent operations, construction companies can emerge stronger, not weaker.

As John Morgan often reminds clients: “Restructuring isn’t just about the numbers; it’s about protecting people, projects, and the future.” For directors in the construction industry, those words have never been more relevant.