What the ATO and Recent Data tells us

July 2025 | BCR Advisory

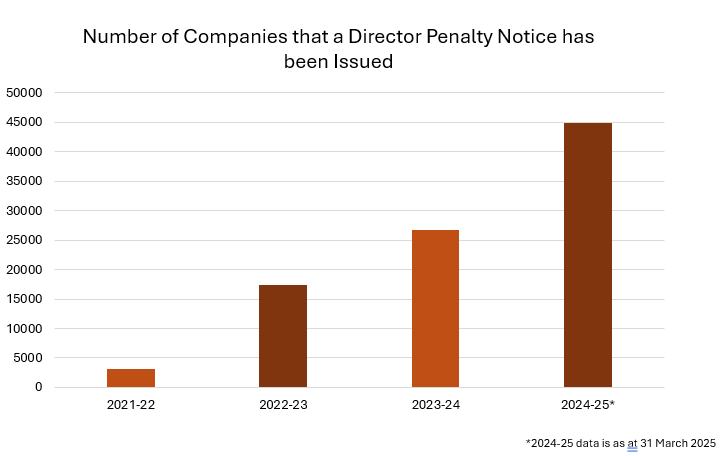

Director Penalty Notices (DPNs): Personal Liability on the Rise

As of 31 March 2025, the Australian Taxation Office (ATO) had issued 59,320 Director Penalty Notices for the year, impacting more than 44,000 companies. The total associated debt was $3.9 billion. They noted that $718.4 million has been recovered- an 18.4% collection rate.

“Clearly the ATO will put the foot down harder on the accelerator, as this seems a disappointing return from their perspective” – John Morgan, Director.

This data shows the ATO’s renewed focus on enforcement. Directors who fail to meet their tax reporting obligations-particularly in relation to PAYG, Superannuation, and GST are increasingly exposed to personal liability under the expanded DPN regime.

“I’m concerned that accountants may not be warning their business clients with tax arrears about the scope of DPNs and the risk of personal exposure to company debts. Alarm bells should be ringing” says John Morgan.

Key takeaway: If your company has unpaid tax liabilities, ignoring the issue could lead to personal exposure as a director. Early engagement and advice are essential.

Garnishee Notices: ATO Steps Up Pressure

The ATO has also issued more than 10,000 garnishee notices so far in FY2025. These are commonly used where a business owner:

- Fails to engage with the ATO

- Engages in phoenix activity

- Has unpaid superannuation

- Is seen to be avoiding payment obligations

A garnishee notice allows the ATO to recover funds directly from a debtor’s bank account or third party. It’s often a last step before winding-up action is considered.

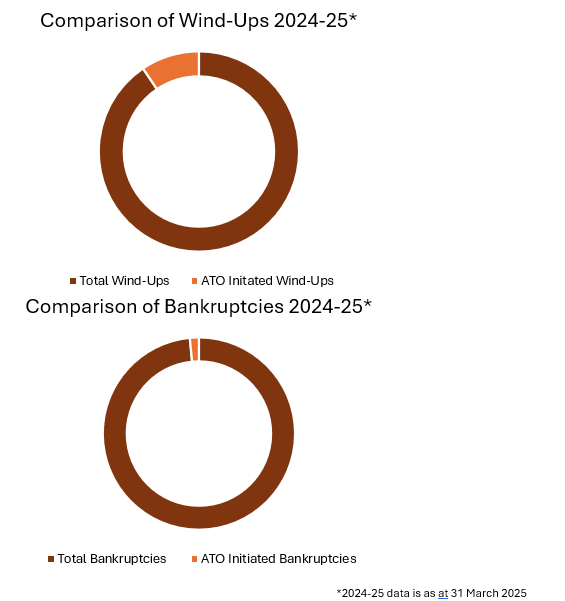

Winding Things Up

Between July 2024 and March 2025, Australia recorded:

- 7,703 corporate wind-ups, only 9% initiated by the ATO

- 5,146 bankruptcies, just 2% ATO-initiated

Contrary to myth, the ATO, while active, is not directly initiating most of the total Winding up Application. The ATO reported that many business owners began restructuring or winding up on their own. This is likely often due to tax reasons, but better than instead just waiting for formal enforcement.

“I hope this reflects a maturing approach to financial distress-from the impacted directors now starting to act early to preserve value”.- John Morgan, Director.

Small Business Restructuring (SBR): A Viable Lifeline

In just four years, Small Business Restructuring (SBR) has become the second most common corporate insolvency pathway. At BCR Advisory, we’ve assisted with approximately 200 SBRs since 2021. Of these:

- 172 plans have proceeded-an 86% conversion rate

- Only 16 were rejected and 8 did not proceed

- These plans involve $50 million in admissible debt

- Of this, Creditor’ expected return is $19 million – an average dividend of 38%

- 60 plans have been effectuated (finalised) already

These figures highlight the growing success of the SBR framework in providing structured, realistic solutions for distressed but viable businesses.

As John Morgan says, “BCR Advisory is proud to be one of the top providers of SBRs in the country by number and success rate. We’ve attained this leadership through good dialogue with the ATO, understanding their requirements, and our good processes honed by working with so many businesses”.

What This Means for Business Advisors and Accountants

The key message? Don’t wait. The ATO is enforcing more aggressively, and directors have more at stake than ever before. But there are clear, structured options available-particularly for small businesses willing to engage early.

Whether it’s exploring a small business restructure, responding to a DPN, or managing creditor pressure, our team at BCR Advisory is ready to provide practical, commercial advice that helps protect value and unlock future options.

Need Advice or a Second Opinion?

Our advisors are available for confidential, no-obligation discussions to support you or your clients or business through periods of uncertainty. We also offer tailored training sessions for accounting and legal teams who wish to stay up to date with the latest developments.

BCR Advisory

Level 5, 1 Margaret Street Sydney NSW 2000 Australia

Stay informed. Stay prepared. Stay in control.